Analysis of the results of FEDER grants for storage projects in Spain

We now have the results of the first call for grants for energy storage projects financed with FEDER funds. Given that storage is set to be the star technology in the coming years, it is worth analysing these results in detail to gain a better understanding of the market.

The full results published by the IDAE can be consulted here.

Summary of results

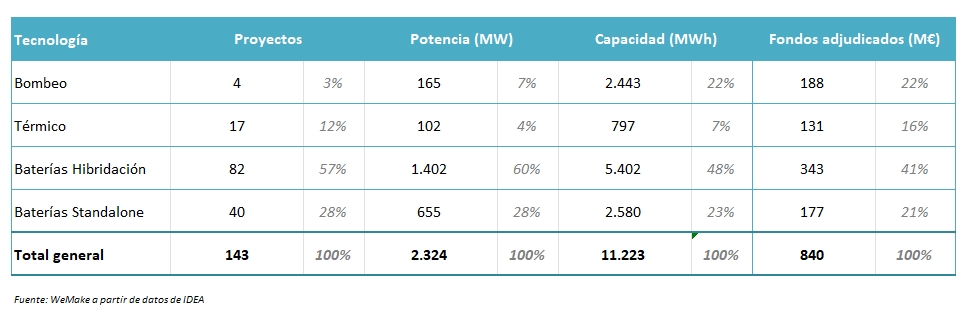

143 projects were selected from the 1,750 submitted, meaning that only 8% of applications received funding.

As can be seen in the table above, battery projects accounted for the majority with 85%, followed by thermal projects with 12%. Pumping projects only account for 3% of the projects, but as they are very large, they represent 22% of the total capacity.

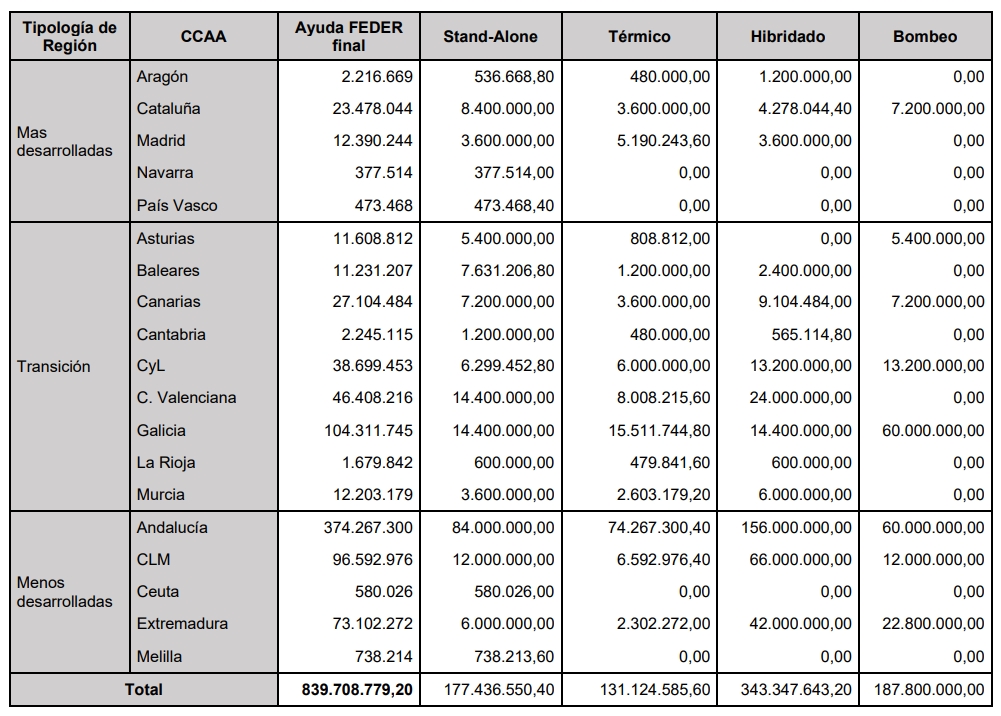

A total of €840 million has been awarded, 20% more than the €700 million initially planned. In terms of distribution by autonomous community, projects in Andalusia have received 45% of the funds, followed by Galicia with 12% and Castilla la Mancha with 11%.

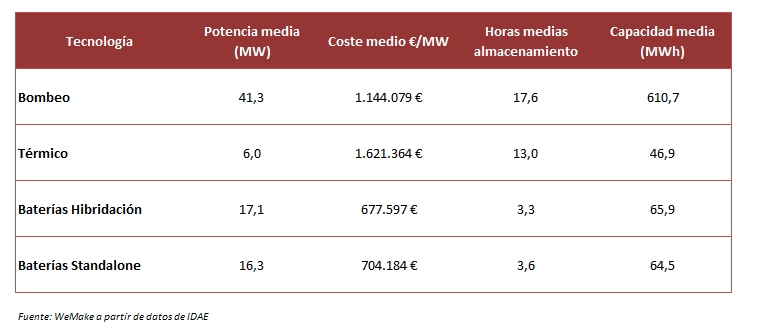

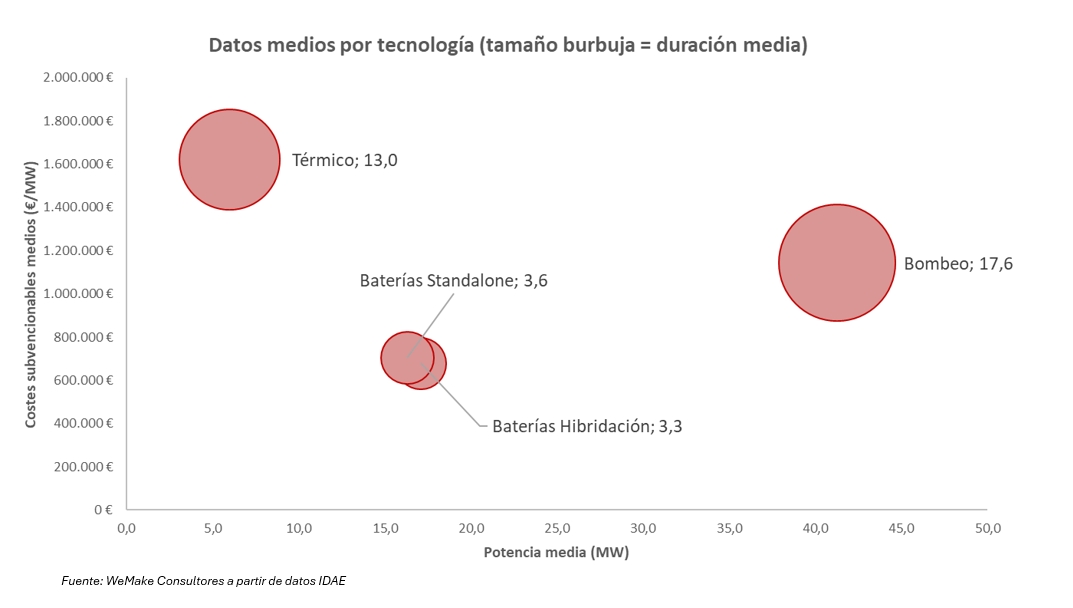

Analysing average data by technology

Battery projects are the most competitive in terms of cost, with an average of around €700k/MW in eligible costs. At the other end of the scale are thermal projects, which are also the smallest in terms of power. In terms of size, pumped storage projects are clearly the largest in terms of both average power and capacity, exceeding an average of 17 hours of storage. Battery projects have an average duration of 3.5 hours, which is sufficient for arbitrage applications.

The novelty: local content

The main new feature of this call for grants was the inclusion of a criterion of “Value Chain and Contribution to Resilience”, with a maximum of 6 points out of a total of 100 if the equipment used was manufactured in the European Union.

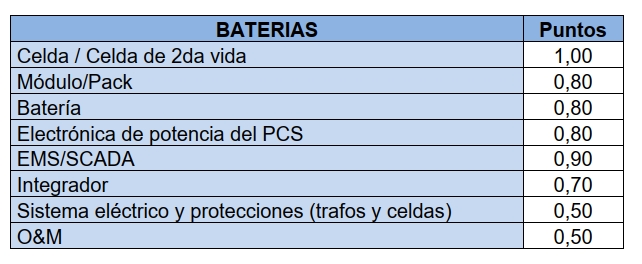

The design of this criterion (approved at European level in the NZIA) is very appropriate as it does not greatly affect the final score, but obtaining a minimum of 3 points was eliminatory. In addition, the higher the score obtained, the greater the intensity of the grant, which further incentivises the purchase of European equipment . For batteries, the points were broken down as follows:

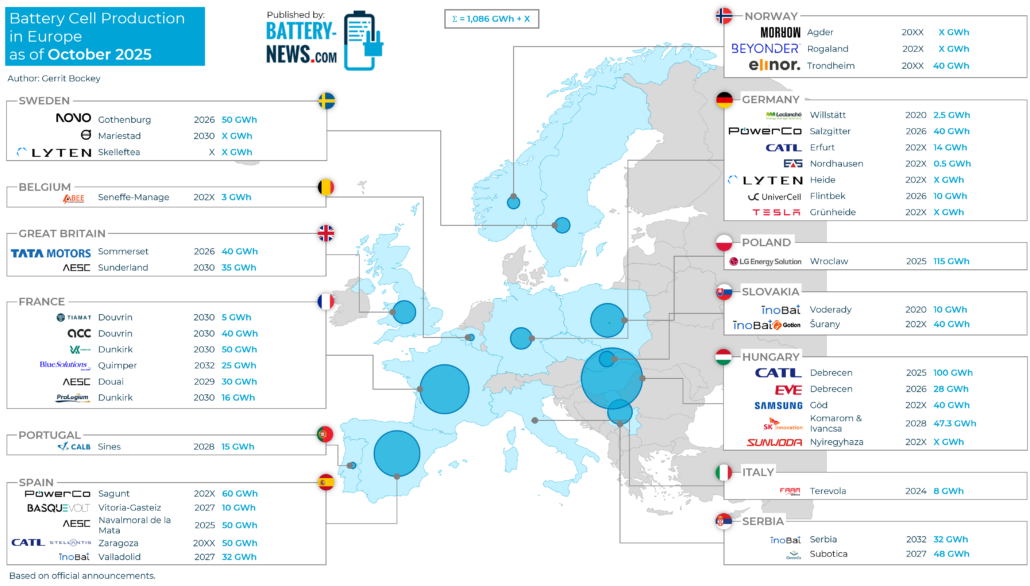

It is clear that the most difficult components to source from European manufacturers are batteries, modules and cells, as the vast majority of these are of Chinese origin. In fact, European-made cells are scarce and most of the planned factories are not yet operational, as shown below.

Following the bankruptcy of Northvolt and the strategic reorientation of Freyr, cell manufacturing in Europe today is dominated by South Korea’s LG Energy in Poland, China’s CATL in Germany, France’s SAFT and InoBat (with China’s Gotion) in Slovakia as the main players. Furthermore, not all of them manufacture LFP cells, which are suitable for energy storage applications, meaning that supply for this type of project is currently very limited.

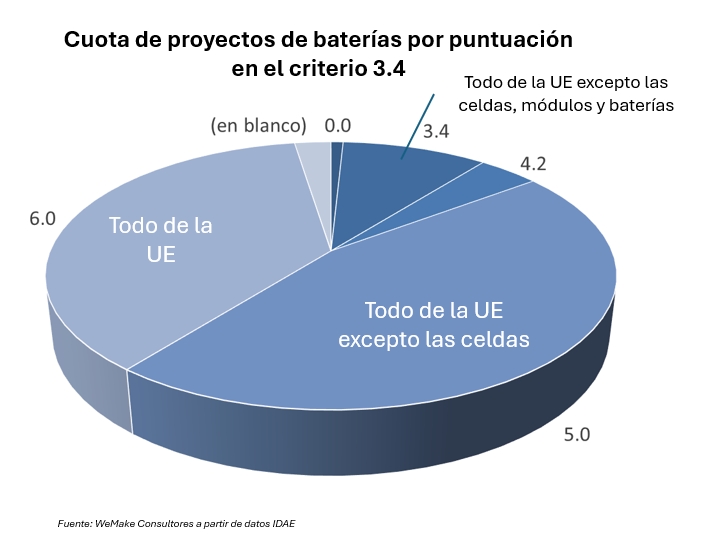

If we review the scores for this criterion in battery projects, it is quite surprising that 37% have obtained the maximum score, stating that their supply chain will be 100% European. Forty-six per cent have obtained 5 points, meaning that everything except the cells will be European, which is a much more likely scenario. Ten per cent obtained 3.4 points, meaning that they are assumed to purchase their batteries entirely from China.

The truth is that these results are surprising. The 3.4 points for everything other than batteries was clear, as we have many European and even Spanish suppliers of PCS, O&M and integration, but in terms of batteries, I believe that developers have played with the deadlines and factory plans in Europe of some Chinese players such as CATL, EVE and AESC (in Spain). In any case, this demonstrates the success of this type of criteria in auctions and public aid, as it incentivises and rewards the use of local products, thereby attracting new industry or strengthening existing industry.

Battery Projects

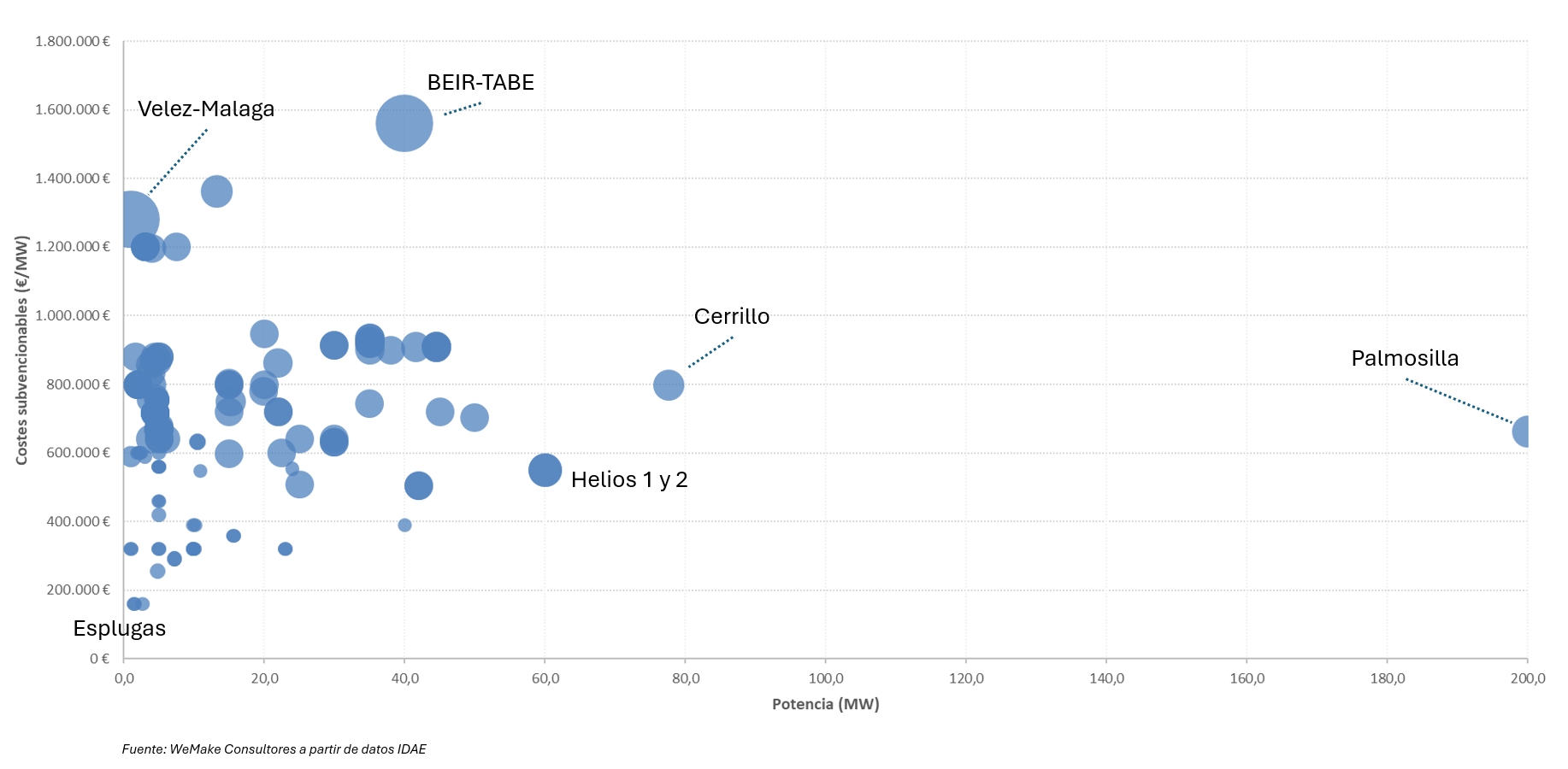

Looking at the 122 battery projects graphically, there are some things that stand out:

- Palmosilla Project: developed by RolWind, it is by far the largest of the winners. It is a 200 MW/885 MWh battery for a total of 4 hours of net storage. It is planned for Tarifa (Cádiz) and its details are published in the BOE. If it goes ahead, it would be one of the largest batteries in Europe, although there are already environmental organisations opposing the project. The developer is RolWind, which has made its ambition clear, as the second largest battery project (Cerrillo) is also theirs, and both have obtained 5 points in the European manufacturing criterion, as they plan to use central inverters from Power Electronics and batteries from Powin (whose cells are Chinese).

- BEIR-TABE project: this is one of the most striking projects, as it claims 40 MW of power and 8 hours of storage in a hybrid configuration. With that duration, it could be a technology other than lithium flow batteries, but with that size it is unlikely. If it were lithium, it would be one of the longest-lasting batteries in Europe. In addition, it claims 6 points in European manufacturing and has the highest cost per MW (another clue that could point to alternative technology). I have not been able to find details of this project, but it will be interesting to follow up on it to solve the mysteries it raises.

- Espluga hybrid projects: these are three projects with a total of 6 MW of storage located in Catalonia that will be hybridised with solar and wind farms. The developer is the Austrian company RP Global, and it is noteworthy because these projects declare the lowest eligible cost per MW installed at €160k/MW, which is very low even with current battery prices. In addition, these projects have launched a crowdfunding campaign through Fundeen to raise funds.

- Grid-forming projects: a total of 39 projects totalling 640 MW incorporate grid-forming capacity, a topic we already addressed in this blog following the blackout in April. Although they are not in the majority, they already account for a significant proportion of the approved projects and, bearing in mind that there is still no regulation or defined income for this type of service, it is very significant that so many projects have incorporated it (it is true that it added points but also cost).

Starting gun

This call for proposals is undoubtedly the starting gun for what will be a tsunami of storage projects in the coming years. We will see how many of these 143 projects end up being implemented, but it is likely that the trends analysed in this competition will be those we see in the years to come.

We will see the vast majority of hybrid and standalone battery projects with durations of around 4 hours, and hopefully we will continue to see the majority of European manufacturing incentivised to create a local supply chain in a technology as strategic as storage. The storage race has already begun.