Wind and Solar in Spain – Overview 2024

Seventh edition of the summary of renewables in Spain, with a review of the main data summarising a year 2024 marked by the growth of solar energy, the stagnation of wind energy and fears in the sector of price cannibalisation.

The data for this report are publicly available on Red Electrica‘s excellent website. Some of these data are still provisional so they may vary somewhat when they become definitive, but they will be small changes that will not affect the overall picture.

-

Generation: wind power is once again the leading source in the mix

As Red Eléctrica itself announced in December, wind power is once again the leading source of electricity generation in Spain with 23%. It is followed by nuclear and photovoltaic continues its unstoppable rise and is already the third most important source. If we look at the evolution over the last 8 years, we can see the great growth of solar energy, which has gone from an anecdotal 3% to 16.7%. Coal, however, has almost disappeared from the mix, whereas just seven years ago it still accounted for 17%. In total, renewables (including hydro and others) have generated 56% of electricity in 2024, a new record, and if we add nuclear, 77% of the generation has been CO2 free.

-

Demand: downward trend slows down

Here the highlight is that the downward trend of recent years has been broken with an increase of 1%, still far from the highs set in 2018. Undoubtedly, electrification is still a pending issue and we need to increase demand much more, as we mentioned in a previous post in this blog

-

Daily production: wind-solar complementarity is becoming clearer and clearer

- With the strong growth of solar, the seasonal complementarity of solar and wind is becoming increasingly clear.

- On 8 December, wind and solar PV covered 61% of the day’s demand, 1 point below the 2023 peak

- On 21 November, wind power generation reached its daily peak with 440 GWh of production almost 6% higher than the peak of 2023.

- Solar PV, on the other hand, reached peak production on 12 July with 212 GWh, which is 30% more than the peak in 2023.

- On 23 February, the maximum combined wind + solar PV generation reached 497 GWh.

-

Monthly production trend: solar is already the main renewable source in summer

- By plotting the production data by month, the curves are much smoother and the high seasonal complementarity of wind and solar is much better appreciated.

- Overlaying the curves of previous years shows the spectacular growth of solar PV, which already significantly outpaces wind power in the months of May to August.

-

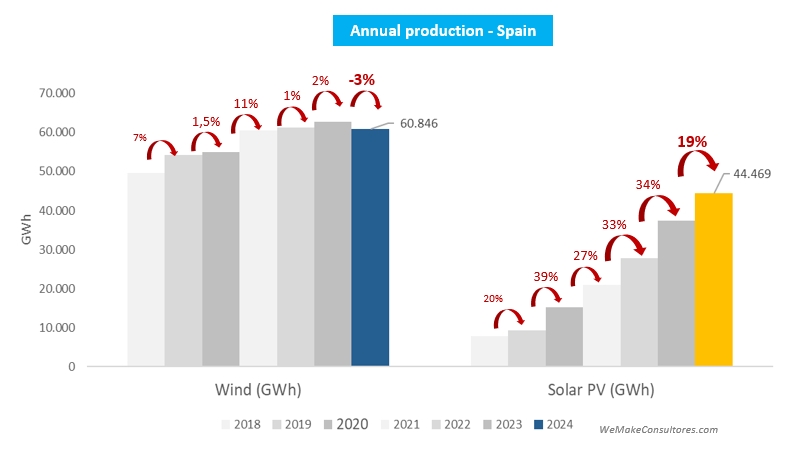

Annual generation evolution: wind power falls for the first time while solar power slows its growth

- Solar PV was once again the main protagonist in 2024 due to its strong growth in annual production, with 19%, which, although far from the figures of recent years, is still very significant.

- Wind power reduces its annual production for the first time in its history. New installed capacity has not been able to compensate for the lower resource and the higher level of curtailment (technical and economic).

-

Installed capacity: new record for solar while wind continues to fall short of the PNIEC

- In terms of installed capacity, according to provisional data from REE, solar would have set a new record in 2024 with 6.7 GW installed. Excluding self-consumption, the PNIEC target is 57 GW in 2030, so at an average of 4.3 GW per year, solar would reach the target, which seems very feasible.

- Wind power, on the other hand, has not reached the GW installed, a far cry from the 5 GW it would need to install annually to meet the 62 GW target set out in the PNIEC by 2030.

- It is time to forget the PNIEC objective for wind and start thinking game by game, trying to solve the sector’s problems to facilitate the advancement of projects. In a year of concern due to the judicialisation of wind power developments in Galicia, it seems that in Spain we are going in the opposite direction to that set by the European Union to simplify and accelerate developments. Germany has shown us in 2024 what can be achieved in wind development if the right measures are taken.

- In terms of total capacity, probably by the time you read this, solar PV will already be the technology with the largest installed fleet in Spain, with more than 31 GW.

-

Capacity factor: data worsening

- In terms of capacity factor, wind power continues its downward trend and marks a historic low. Solar also fell this year and interrupted the growth it had been experiencing since 2019.

- It should be remembered that the main element affecting the capacity factor is the resource (wind and irradiance) available each year, but there are also other factors such as technology efficiency, maintenance or curtailments. In general, with equal resource we should see better capacity factors as technology and O&M in both solar and wind are becoming more efficient.

- This year we have again heard a lot about the curtailments that have affected wind and solar and although the level of “mandatory” curtailments is still low compared to other countries, it is likely that “voluntary” curtailments, i.e. when the owner is not interested in generation because the prices are lower than the cost of operation, have been important and have worsened the capacity factor.

-

Market prices: from panic in April to above 110 €/MWh in December

- April was the month of panic for the electricity markets as the price plummeted and put many investors who had their projects exposed to pool prices on alert. Since that low, prices have done nothing but rise, ending the year at values above €100/MWh.

- It is curious how in April it seemed urgent to redesign the pricing system and now few are talking about it. I think it is important that in 2025 a calm debate is generated on the marginalist system, which is clearly not designed for a system with a majority of renewable generation.

-

Issues to watch in 2025

Energy policy is not characterised by dynamism, so year after year we seem to inherit the same problems. However, there are some issues that should be moving forward in 2025. Let us review some of them:

- Storage: beyond the PERTE aid for specific storage projects, the whole sector was waiting for the capacity mechanism like a dream come true and it finally arrived on 18 December. The public hearing period has been opened, so 2025 should be the year when the mechanism will be implemented. Let us hope that this will be the definitive signal for storage to take off and alleviate price imbalances

- Offshore wind: in 2024 the whole regulatory package was completed needed to develop projects so 2025 should be the year of the first auction. Although it is likely to be a small project in the Canary Islands, it will be a very important milestone if we want to kick-start the sector.

- Onshore auctions: wind power urgently needs auctions to give visibility and certainty to the sector. Germany has successfully auctioned 11 GW in 2024, while Spain has not. Furthermore, we will have to pay attention to the auction criteria, as this would be the perfect opportunity to apply the Net Zero Industry Act and incentivise local content through resilience criteria.

- Judicialisation of developments: this has been one of the worst news of 2024 as it not only slows down deployment but also scares off investments. Hopefully 2025 will bring some sanity to this situation in Galicia and prevent this practice from spreading to other regions.

- Promotion of electrification: datacenters, electric vehicles, aerothermal energy… in 2025 we should see a clear commitment to demand, with demand tenders and also with more ambitious policies for the promotion of electric technologies.

- Pool price: I am not very optimistic in this respect but I hope that one of the major problems of current energy policy will be tackled: price formation mechanisms. If we continue with high prices, it will affect the competitiveness of the economy, and very low prices will reduce investment in new capacity. We need to work on new mechanisms that provide greater stability and better reflect the real costs of generation.

- Teresa Ribera: Finally, we will closely follow Teresa Ribera’s initiatives as Vice-President for Clean, Fair and Competitive Transition in the new European Commission. It is not easy to guess what specific competences on renewables the Vice-President will have, but hopefully she will have the capacity to manoeuvre and will be able to give agility, ambition and judgement to the European policy on renewables, which is in great need of all of this.

2024 has been a year of transition in which the regulatory framework has been completed in various important areas such as storage, offshore wind or demand auctions, so we hope that 2025 will be a year of execution and that structural problems in the sector that are becoming entrenched will begin to be resolved in a decisive manner.